SINCE 2006 OUR INSURANCE APPRAISERS & ADJUSTERS

HAVE HELPED THOUSANDS OF POLICYHOLDERS

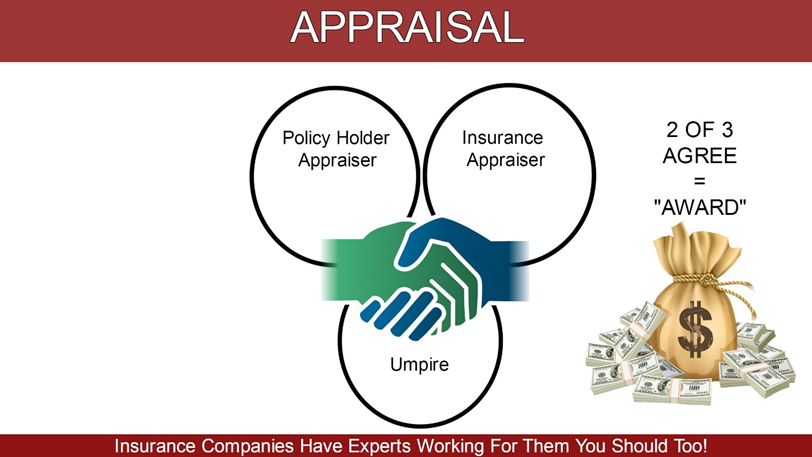

If your home or business was damaged and you want the most fair and adequate settlement, we can settle your claim fast and efficiently and help you to avoid VERY expensive and VERY time consuming attorneys / lawsuits. Our results are far more superior than an attorney and are settled years before they would settle on average. We offer the single best Insurance claim settlement method and also Dispute Resolution method when it comes to the speed of the settlement recovery (months compared to years) and the size of the recovery. Not to mention with us you do not need to give away upwards of 1/3 of your recovery to an attorney. The amount of money you will save by hiring us and NOT USING AN ATTORNEY is on average TENS OF THOUSANDS for an average size claim and more than six figures and we have seen a savings of upwards of seven figures for large commercial claims. The savings of time and money are the major differences as well as being able to put your property back to pre-loss condition or NOT paying ultra expensive attorney fees, which will take away over a third of the total settlement amount. (NOTE: SOME ATTORNEYS ARE NOW SAYING THEY CHARGE 10% BUT YOU DO NOT GET TO SEE THE GLOBAL SETTLEMENT THEY AGREED TO IN THE SETTLEMENT NUMBERS - THATS WHERE THEY TIE THEIR FEE INTO WHERE IT EATS AT THE SETTLEMENT RECOVERY AND THE SETTLEMENT AMOUNT YOU REALLY RECEIVE)

Each One Of Our Appraisers has over 20+ Years Of Insurance Appraisal Experience

Experience is key when it comes to appraisals. Our Large Loss Insurance Appraisers will put their years of experience into providing an accurate report for you. These appraisals may have expert reports within them in regards to weather, engineering, air quality, business interruption, or any other segment of the claim. We feel our experience excels in this portion of the job out of a willingness to be knowledge dominant on our files and the experience to know what happens next.

We have experience in working with real world numbers needed to correct the damage and applicable building codes and regulations that govern same. All of this information will be factored into the replacement cost value detailed in the final report. Having an accurate, comprehensive appraisal report is your best asset when coming to a fair number for the value of a disputed loss.

If you are in need of appraisal services, contact us today to ensure you get a respected and well known appraiser that will fight to get you the best number possible.

In one of our recent Naples, FL residential Hurricane appraisal award, the Insurance Company paid the insured a total of $9,456.80, then our large loss appraiser Bryan E. Thomas was hired and settled the claim for $1,007,906.04, just under a million dollars in "NEW" settlement money. It pays to hire top rated Insurance Appraiser with the experience, expertise and a proven track record of success that spans over 2 decades.

| Insurance Co. Offered |

We Recovered |

% Increase |

$ Increase |

|---|---|---|---|

$10,631.75 |

$124,500.00 |

+1070% |

$113,868.25 |

$13,122.97 |

$101,004.07 |

+669% |

$87,881.10 |

$9,456.80 |

$1,007,906.04 |

+1007906% |

$998,449.24 |

$0 (ZERO, below ded. ) |

$559,214.61 |

+55921361% |

$559,214.61 |

$114,000 |

$ 575,000.00 |

+404.39% |

$461,000.00 |

Selecting the Right Florida Insurance Appraiser is Crucial for a Successful Outcome

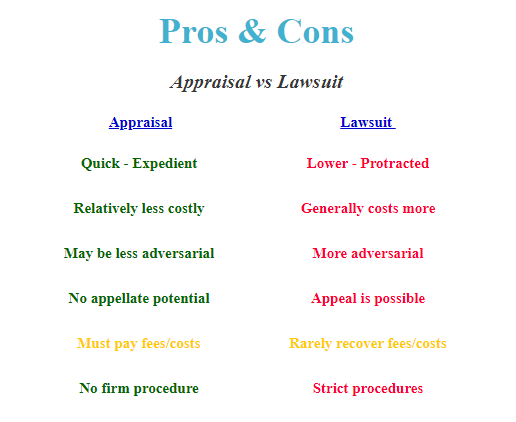

The key to a successful insurance settlement is hiring an expert who knows the ins and outs of the process. It should be noted that many appraisals end up going to umpire and they are the final decision maker as to the final claim settlement payout. Frankly hiring Bryan E. Thomas as your Large Loss Appraiser gives you a distinct advantage because he knows exactly whom to choose as an umpire and has a very short list that he picks from that has been vetted over the past 20 years. We feel knowing which umpire to hire is one of the single most important factors for a successful appraisal award. Also, it helps knowing how to negotiate and come to an agreement quickly with the other appraiser and umpire, Bryan E. Thomas has build relationships over the years that is instrumental on receiving favorable awards. Insurance appraisal is simply the best tool and most cost effective and quickest method for settling insurance claim disputes. Before we invoke appraisal we must make sure your policy has the appraisal provision, we will also need to see the estimate of damages the insurance company provided you with. It is so important to have a veteran, experienced expert appraiser on your side who understands the process, otherwise the the insurance company will very likely have the advantage. When properly executed, appraisal settlements we have found are greatly larger than settlements we would have recovered in other means such as mediation, acting as your public adjuster or worse, using an expensive and time consuming attorney.

It is the job of a Florida Insurance Appraiser to assess and evaluate the damage and provide an impartial, informed estimate of the value of the loss. The policyholder and the insurance company both will have their own independent insurance appraiser assess the damage, and if the two appraisers cannot agree then a third insurance appraiser will be used to resolve the differences. The third insurance appraiser is called an umpire and is either agreed between the appraisers or appointed by a court having jurisdiction. Insurance Appraisal boils down to an agreement of two of the three appraisers. (SEE BELOW)

What is an Insurance Appraiser?

Insurance Appraisers are experts on property loss adjustment who are retained by policyholders to assist in preparing, filing and adjusting insurance claims. Employed exclusively by a policyholder who has sustained an insured loss, these professionals manage every detail of the claim, working closely with the insured to provide the most equitable and prompt settlement possible. A Insurance Appraiser inspects the loss site immediately, analyzes the damages, assembles claim support data, reviews the insured’s coverage, determines current replacement costs and exclusively serves the client, not the insurance company.

A recent settlement recovery, the insurance company paid the insured a total of $9,456.80, then hired Bryan E. Thomas of National Adjusters to be their Insurance Appraiser and we settled the claim for $1,007,906.04, just under a million dollars in additional "NEW" settlement money. It pays to hire a Insurance Appraiser with the experience, expertise and a proven track record of success.

Hiring our A+ rated Florida Insurance Appraiser means your chances of getting the largest possible appraisal settlement are dramatically increased. Our Insurance Appraiser can be retained to adjust disputes ranging from homeowner insurance claim, condominium claims and commercial insurance claims.

National Adjusters team have been considered top experts and leaders among the insurance claims industry for decades. Our Insurance Appraiser specialize in fire damage insurance claims , water damage claims like pipe breaks / leaks or slab leaks, flood damage claims and an assortment of other property damage claims (we do NOT handle auto claims). Our Insurance Appraiser have also been representing insurance appraisals for policyholders for disputes with natural disaster claims such as tornado claims, hail, wildfire, earthquake and hurricane claims.

Understanding the Florida Insurance Appraisal Process Insurance companies include an appraisal or arbitration clause in every policy. The clause stipulates that in the event that the property owner and the insurance company cannot agree on the value of the loss, either party may demand an appraisal and, in some occasions, that both parties must agree to enter into an appraisal.Each party selects an appraiser and the two appraisers — one from the policyholder and one from the insurance company — work together to agree on the value of the damaged property. A mutually agreed-upon or court-appointed umpire will handle any disputes between the appraisers, and any agreement signed by two of the three parties will set the value of the loss. Arbitration is similar except that instead there is a panel of arbitrators that form the position of the umpire in appraisals and the lawyers or advocates for the parties present to the sometimes one person sometimes three panel of arbitrators.

Sometimes there is a disagreement over the insurance company's valuation of an insurance claim. Policyholders often think the only way to settle the dispute is to hire a lawyer. Fortunately, this is not the case. National Adjusters & Bryan E. Thomas can be hired at act as your Florida "Insurance Appraiser" for Appraisal, which is a method of Alternative Dispute Resolution often found in many homeowner and commercial insurance policies.

The language will often, but not always, state that appraisal is mandatory when properly demanded by the insurer or insured. It is important to have a qualified Appraiser review your policy to determine your options. When properly executed, appraisal is binding on the parties as to the amount of loss only. Appraisal does not determine coverage. If not properly invoked, employed, and/or carried out the process may not be binding, so it is important to select a qualified appraiser and umpire.

Rather than engaging in prolonged and expensive litigation, this alternative dispute resolution process can save both parties significant money and time. Complete has a long-standing record serving as the appraiser for homeowners and insurance companies, as well as the umpire in disputes between the parties.

Whether the damage is due to fire, flood, wind storm, hail or other natural phenomena, Complete has the experience working on residential, commercial, and industrial properties from every angle to know how to resolve discrepancies and disagreements. We are intimately familiar with the actual time and realistic costs of materials it takes to bring a property back to its original state.

Rather than engaging in prolonged and expensive litigation, this alternative dispute resolution process can save both parties significant money and time. Bryan E. Thomas has a long-standing record serving as the appraiser for ONLY homeowners, as well as the umpire in disputes between the parties.

Whether the damage is due to fire, flood, wind storm, hail or other natural phenomena, Bryan has the experience working on residential, commercial, and industrial properties from every angle to know how to resolve discrepancies and disagreements. He is intimately familiar with the actual time and realistic costs of materials it takes to bring a property back to its original state.

The appraisal language in a HO3 policy typically reads as follows:

Appraisal. If you and we fail to agree on the actual cash value, amount of loss, or cost of repair or replacement, either can make a written demand for appraisal. Each will then select a competent, independent, appraiser and notify the other of the appraiser's identity within 20 days of receipt of the written demand. The two appraisers will choose an umpire. If they cannot agree upon an umpire within 15 days, you or we may request that the choice be made by a judge of a district court of a judicial district where the loss occurred. The two appraisers will then set the amount of loss, stating separately the actual cash value and loss to each item.

Contact Bryan E. Thomas and National Adjusters to act as your appraiser. Once hired our Florida Insurance Appraiser will invoke the Appraisal clause/provision, the insured's appraiser and the insurance carrier's appraiser will estimate the damage and try to come to an agreement on the amount of loss.

If the appraisers fail to agree, they will submit their differences to the umpire. An itemized decision agreed to by two of these three will set the amount of loss. Such award shall be binding.

Each party will pay its own appraiser and bear the other expenses of the appraisal and umpire equally.

To inquire about the services of National Adjusters to act as your insurance appraiser, please fill out this form below.

When you have a homeowners claim dispute you should have representation right away from a top rated Insurance Appraiser. You will receive more with us representing you than an attorney

Commercial property damage claim disputes are severely underpaid more than most claims. Not using an Insurance Appraiser on a commercial dispute is a mistake. Keep in mind attorneys fees can be upwards of 50% of your dispute settlement

Our Insurance Appraiser have assisted countless condominium associations claims over the years and have obtained multi million dollar appraisal settlements for our clients. The insurance company does NOT want to pay, as your Insurance Appraiser we will make them!

National Adjusters, Inc. may be able to assist you on many types of claim disputes. We help with property damage appraisal and we do NOT handle AUTO claims

A+ Rated Insurance Appraiser

Please Watch This Short Informative Video